Important information about Thai withholding tax

Withholding tax is unique to Thailand and is a tax that must be deducted from all your supplier invoices and goods which you purchase in order to claim them as part of your expenses.

If you don’t deduct withholding tax on your purchases then you can’t claim back VAT either as they will not be recognised as a business expense.

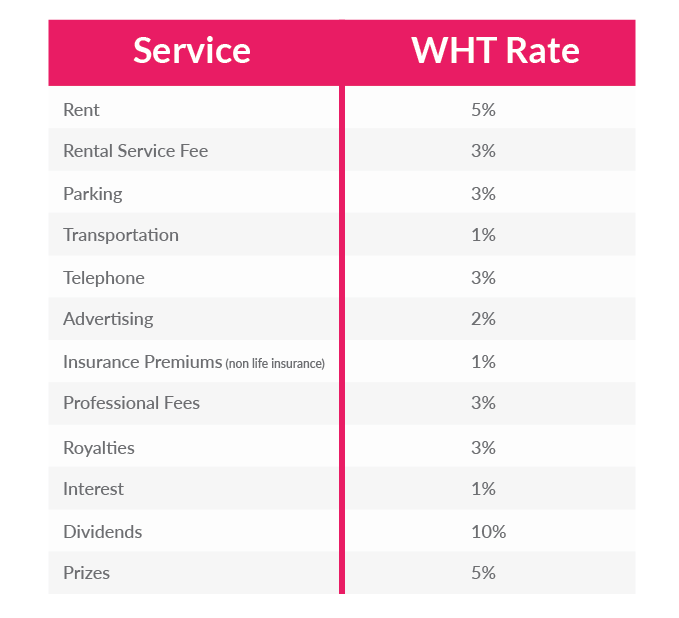

Withholding tax amounts vary depending on the type of service being provided and can be viewed below.

Some services such as web hosting are exempt from withholding tax but utilities such as rent, telephone and internet are subject to WHT. However electricity and water are exempt.

Any bill under 1000 THB is also exempt unless it is a regular monthly service charge such as telephone.

If you have an invoice from a BOI company then in many cases you don’t need to deduct WHT but it is best to check with their accounting dept beforehand.

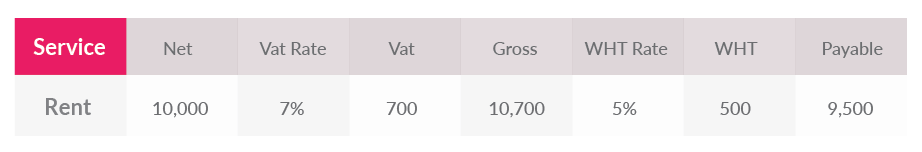

When calculating the amount to pay the WHT deduction is calculated net of VAT.

For example:

The WHT deducted is paid to the Revenue Department byn the 7th day of the following month in which the payment was made. E.g. a payment made on 28th April 2018 to a supplier will require the WHT deducted to be paid to the RD by the 7th May 2018.

Be careful not to pay late or you will need to pay a fine.

The fine for late submission is:

- 100 baht within the first 7 days

- 200 baht after 7 days

An additional penalty of 1.5% of the outstanding amount calculated monthly.