Taxes in Thailand, what do I need to know,

if I only have a small business here in Thailand?

There are different types of taxes which you need to be aware of as a small business owner in Thailand.

First of all there is personal income tax for you and your employees.

If you are employed by your company and have a work permit then you need to pay tax on an income of 50,000 THB per month whether you actually pay yourself that much or not.

Next, you may need to deduct tax from your Thai employees, this may or not be necessary depending on their choices and their income level.

Unlike many western countries Thai employees have the choice of whether their employer deducts tax from their salary or whether they save the money each month and pay it themselves when they submit their income statement to the revenue each year.

You are not responsible for your employees income tax unless you and your employee agree that you will deduct it from their salary and pay it on their behalf. If you agree to do this then it must be paid without fail every month, even if the company falls into financial difficulty. This is not your money and not paying your employees tax can cause big problems for you and for them.

Depending on your employees level of income, they may not need to pay tax at all. Unless they earn at least 60,000 THB per month then they will not need to pay tax.

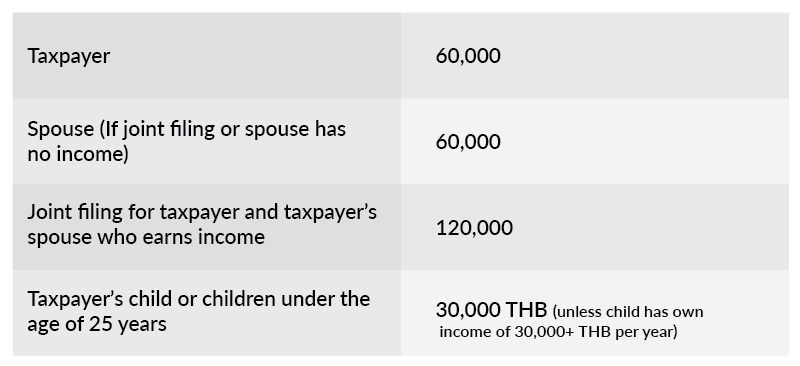

The personal income tax allowances from 2017 onwards are listed below

As well as personal income tax, you also need to know about corporate income tax which businesses have to pay at a rate of 10% on any profits over 300,000 THB.

Half way through the year the business owner needs to make a prediction on the net income and tax due for the total year. They also need to pay 50% of this tax by the end of the 8th month. If you underestimate your amount of tax due then there will be a fine of 20% on the tax arrears.

Withholding Tax

Withholding tax is unique to Thailand and at first it can be quite difficult for foreigners to relate to the concept of it.

WHT is deductable at source meaning that it is deducted by the person who is paying you the funds.

If you invoice a supplier for a service, they will deduct a percentage and pay it to the government on your behalf and issue you with a WHT certificate which you must keep and submit with your end of year balance sheet.

If you pay a supplier in Thailand then you must deduct WHT whether it is an individual or a company unless it is an employee.

Employees are dealt with differently as we mentioned above.

You must then issue them with a WHT certificate (your accountant can help you with this) and pay the tax to the revenue before the 7th day of the month after the payment was made to the supplier.

For example if you make a payment on 31st May, you must pay the WHT to the revenue by the 7th June. If you make a payment on 1st June, you must pay the WHT to the revenue by 7th July. Late payment or failure to pay will result in a fine of 100 THB if you are less than 7 days late. 200 THB if you are more than 7 days late and an additional penalty of 1.5% of the outstanding amount calculated monthly.

VAT – Value Added Tax

If your company turns over more than 1,800,000 THB in a year then you must register for VAT within 30 days of reaching that turnover. This can result in another visit to your office, this time from the revenue department who may call in to chat and ask questions about/require examples of your customers. This is usually quite straight forward, however it is very important to ensure that your VAT is correct as mistakes can result in heavy fines.

VAT returns must be submitted and any outstanding VAT must be paid to the revenue by the 15th of each month. VAT is paid one month in arrears like WHT.

For example if you receive a payment from a client within Thailand on 31st May, you will pay VAT on that payment by 15th June. If you receive the payment on 1st June, you will pay the VAT by 15th July. There are hefty fines for paying VAT late so always make sure that you can pay on time.

Corporate Income tax

If your business has profit of more than 300,000 THB per year then you will need to pay corporate income tax. The corporate income tax rate is 20%.

Sign Tax

If you have a sign outside your office or company then you also need to pay sign tax. Sign tax is usually payable once per year by the 31st March and should be paid at your local District office. You need to supply a photo of the sign along with its size and the date it was erected. A copy of your company registration documents dated within the last 90 days and a receipt for the previous years signage tax if applicable.

Sign tax rates are 3 baht per 500 square centimeters for signs which only have Thai words.

Signs with Thai and foreign text and/or pictures are taxed at a rate of 20 baht per 500 square centimeters.

Signs with only foreign text or have foreign text above the Thai text are taxed at 40 baht per 500 square centimeters.

The minimum amount of sign tax you can pay is 200 baht. If you need help with tax or other accounting services you can contact [email protected]